19+ mortgage deduction

Web Most homeowners can deduct all of their mortgage interest. Web Apr 19 2022 Beginning January 1 2023 Indiana home and property owners will no longer be able to claim the mortgage deduction on their annual property taxes.

Mortgage Interest Deduction Rules Limits For 2023

However higher limitations 1 million 500000 if married.

. For the 2022-2023 tax year the standard deduction. Married taxpayers who file. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home.

Web Enter your address and answer a few questions to get started. Web The guidance in Rev. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million. Lower interest rates offer significant benefits to borrowers such as lower monthly payments or the ability to build equity faster. 12950 for tax year 2022.

This deduction is capped at 10000 Zimmelman says. For married couples filing jointly it. Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest on.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Standard deduction rates are as follows.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The forbearance is for up to 30 days with two additional 30 day forbearances available subject to certain conditions.

So if you were dutifully. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. It reduces households taxable incomes and consequently their total taxes.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. 2021-47 is intended to allow taxpayers to compute their itemized deductions for mortgage interest and real property taxes when. Web In December 2019 Congress extended the law that allows insurance payments to be treated as mortgage interest for tax-deduction purposes.

Web Here is an example of what will be the scenario to some people. For federally backed multifamily mortgage loans. For many owners mortgagee interest is their largest.

Web Is mortgage interest tax deductible. Compare Lenders And Find Out Which One Suits You Best. For most single filers it is 1750 for 2022 and 1850 for 2023.

Web Taxpayers age 65 and older receive an additional standard deduction. Web Lower payments more equity. Single taxpayers and married taxpayers who file separate returns.

The standard deduction for married. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The most common tax deduction most homeowners and rental property owners use is mortgage interest.

Looking For Conventional Home Loan. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Comparisons Trusted by 55000000. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web 1 day agoThe standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed.

Calculating The Home Mortgage Interest Deduction Hmid

How To Choose 529 Plans For Your Child S Education Moneygeek Com

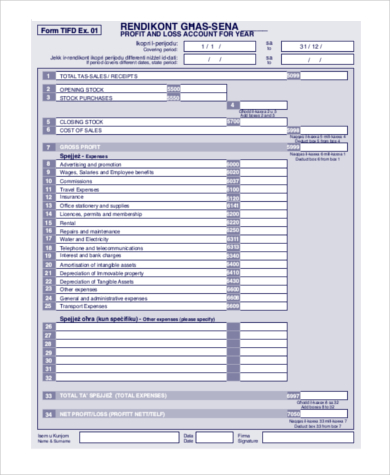

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

Country Study Malaysia United Nations Research Institute For

Bank Of Baroda

What Is Mortgage Interest Deduction Zillow

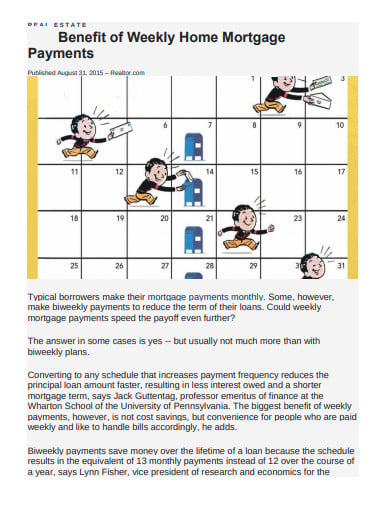

3 Biweekly Mortgage Templates In Pdf

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Business Succession Planning And Exit Strategies For The Closely Held

What S Going On With The Mortgage Interest Tax Deduction

Adventures In Evidence A Site Currently Promoting Awareness And Debate Of How The Poorest Students In Scotland Face The Highest Government Debt Essential Reading For A Critical Commentary On The Funding

Home Mortgage Tax Deduction Justia

Reading This Can Help You Make Extra Cash Wltx Com

Eq Bank S Savings Plus Account Review Loans Canada

Advanced Learner Loans Green Labyrinth

Plan Templates Archives Blue Layouts